Computershare fulfils the registry needs of 50% of the ASX200 and in 2020 managed over 2200 virtual and hybrid meetings across the globe. Our expertise enables us to provide in-depth insight into the AGM landscape. This report analyses the AGMs that Computershare helped to deliver in Australia throughout 2020.

Key insights:

Computershare’s Australian clients embraced online meetings – 68% of AGMs held in 2020 were either virtual or hybrid

Our clients saved $2million AUD on postage and printing, thanks to our Notice and Access solution

Our clients saw an encouraging rate of digital adoption with 76% of shareholders voting online

25% of shareholders on average, supported more transparent climate-related disclosures

93.6% of votes were lodged prior to the meeting, an increase of 1.6% from 2019

AUSTRALIAN MEETINGS

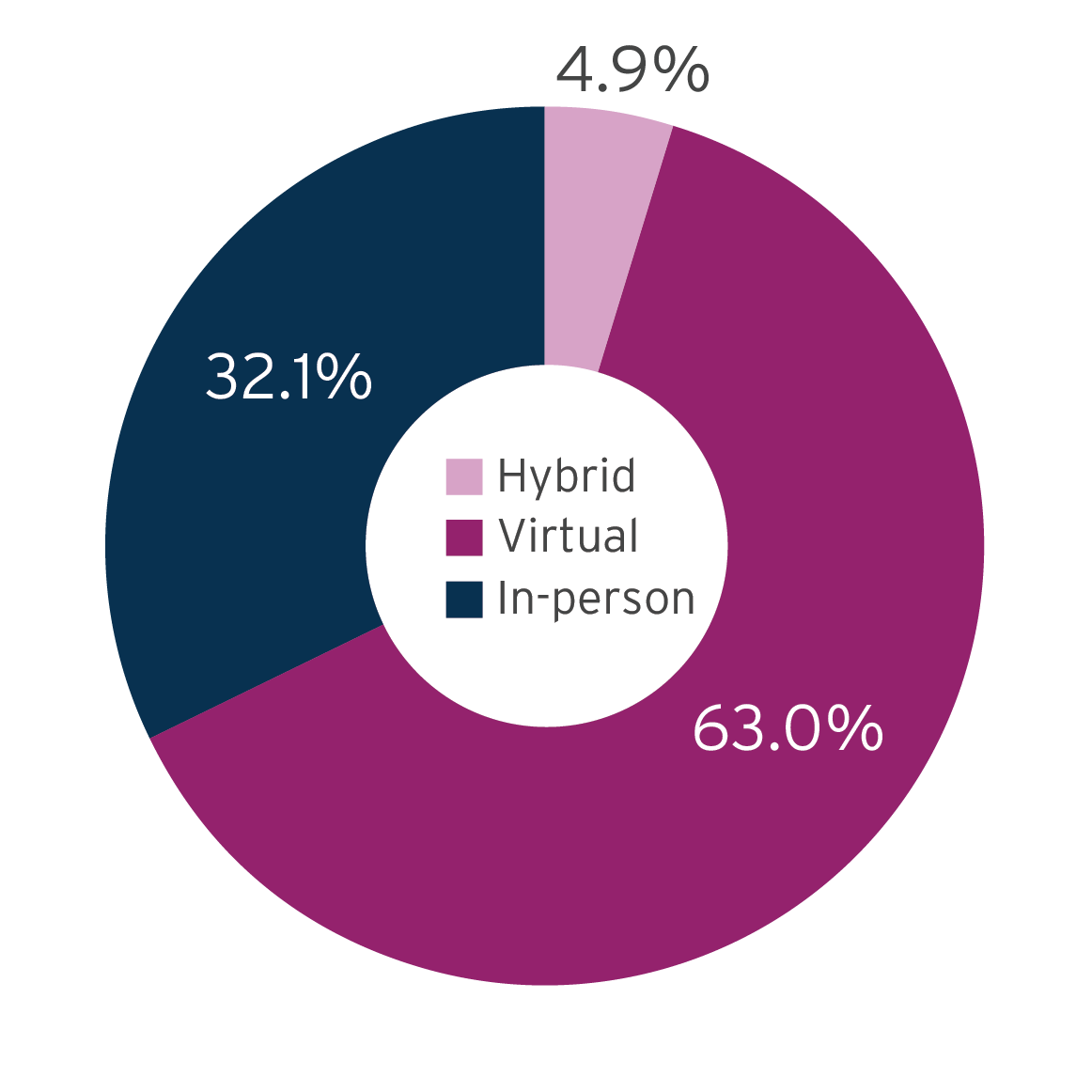

In Australia, 68% of our clients held either a virtual or hybrid AGM

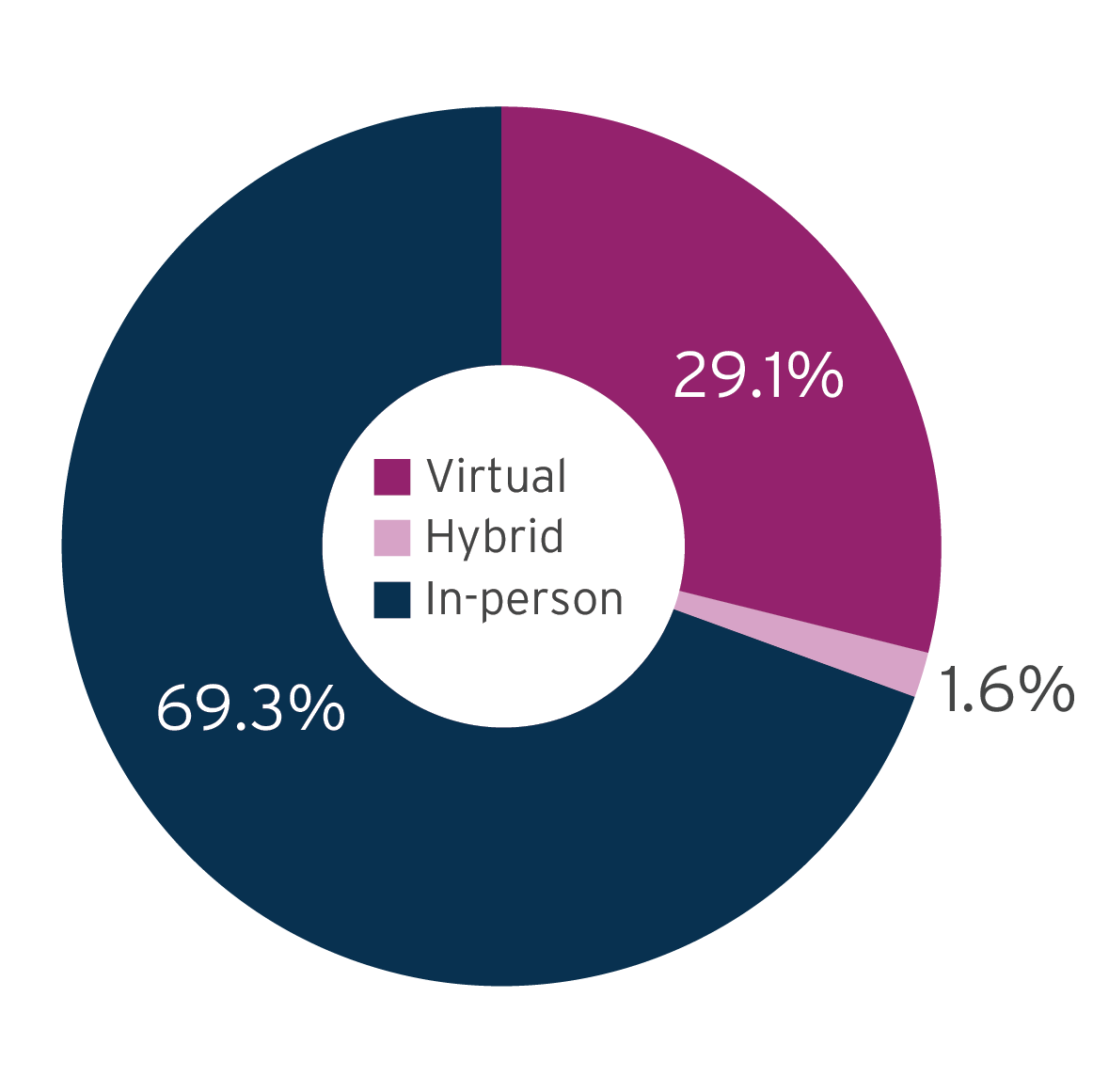

Computershare managed over 2200 virtual and hybrid AGMs globally, with 400 held in Australia.

Even across Australia the landscape varied. In some states the number of physical meetings held were higher, due to less restrictions being in place.

Over the last few months we have witnessed how the environment can change at a moment’s notice. So as part of the AGM planning process, especially if issuers are considering physical meetings, they need to consider what contingencies they have in place, should a sudden change occur.

Australian AGM Types

Global AGM Types

ONLINE ENGAGEMENT

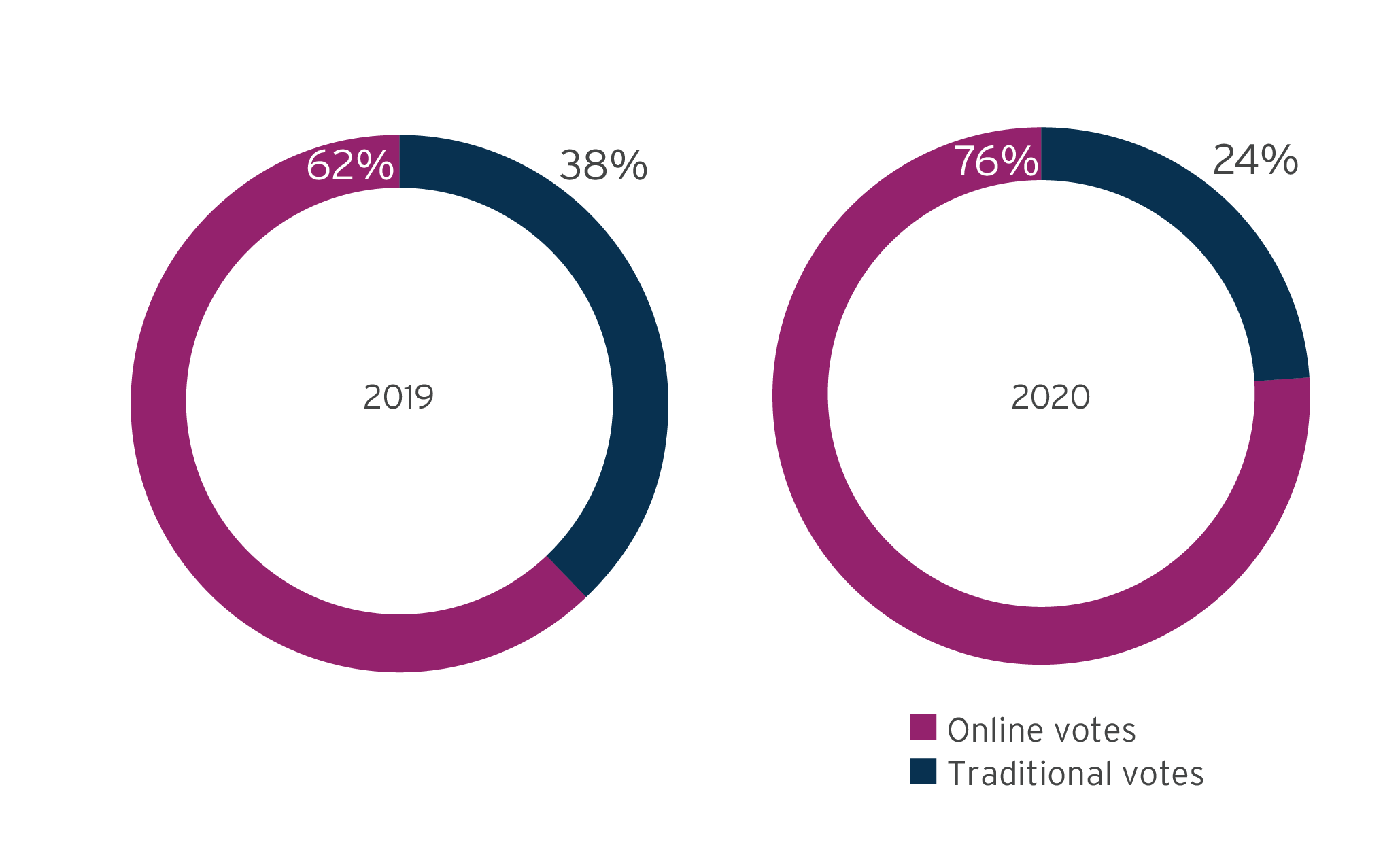

76% of shareholders voted online

Shareholder adoption of online voting is up 14% in 2020, the biggest increase we've seen in recent years.

It suggests that investors are continuing to embrace the digital shift and what we saw in 2020 was an unavoidable digital acceleration. We believe the numbers will continue to trend upward over the next few years.

Issuers should consider putting digital engagement at the forefront during their 2021 planning. A strong and sustainable digital focus is an important part of any long term shareholder engagement strategy.

Traditional vs Online Voting

The number of shareholders using InvestorVote in 2020 is up 22%

DIGITAL COMMUNICATIONS

Our clients saved $2 million AUD on print and postage costs, with our digital Notice & Access solution.

Paper usage declined by more than 6 million pages, helping clients to further reduce their carbon footprint.

The key now, is for issuers to stay abreast of any temporary relief provided by the government. Regardless of the outcome, Computershare has a suite of solutions designed to help issuers remain compliant and communicate effectively with their shareholders.

SHAREHOLDER ACTIVISM

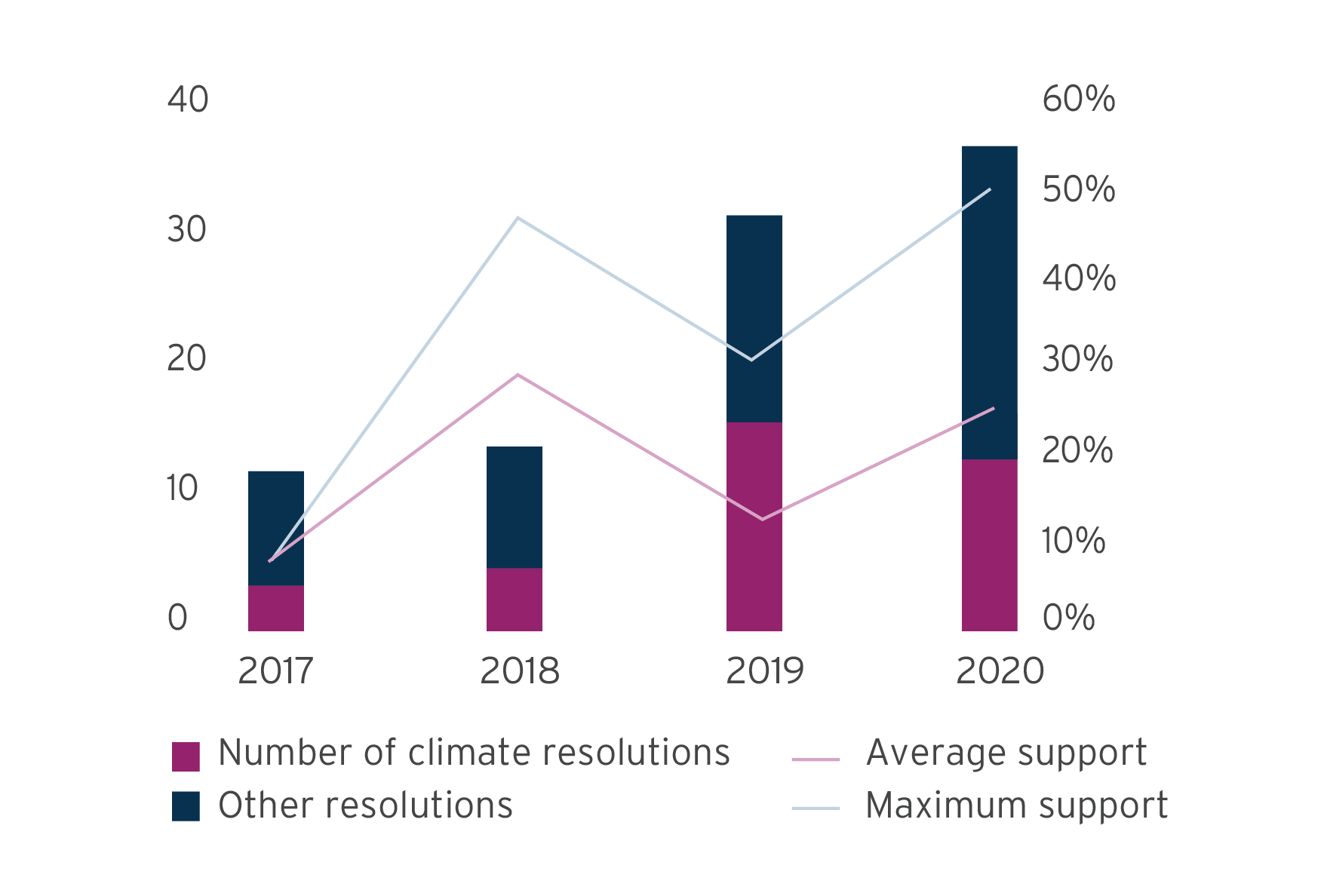

25% of shareholders supported more transparent climate-related disclosures and greater action by issuers

Average support for climate-related shareholder resolutions increased from 13.2% in 2019 to 25.3% in 2020. One resolution even achieved majority support, a feat previously unseen in Australia.

Previously, institutional investors, including index funds, have used engagement with boards and management to stress the importance of ESG disclosure and performance, but where they are witnessing inadequate action, they are increasingly willing to vote in support of shareholder resolutions or against director re-elections.

Shareholders want assurance that issuers are adequately managing their ESG risks, as they can be material to positive long-term shareholder returns and sustainability. Issuers therefore need to understand the expectations of their shareholders around ESG and build a strategy towards better alignment.

Support for Climate Related Resolutions

VOTING LODGEMENT

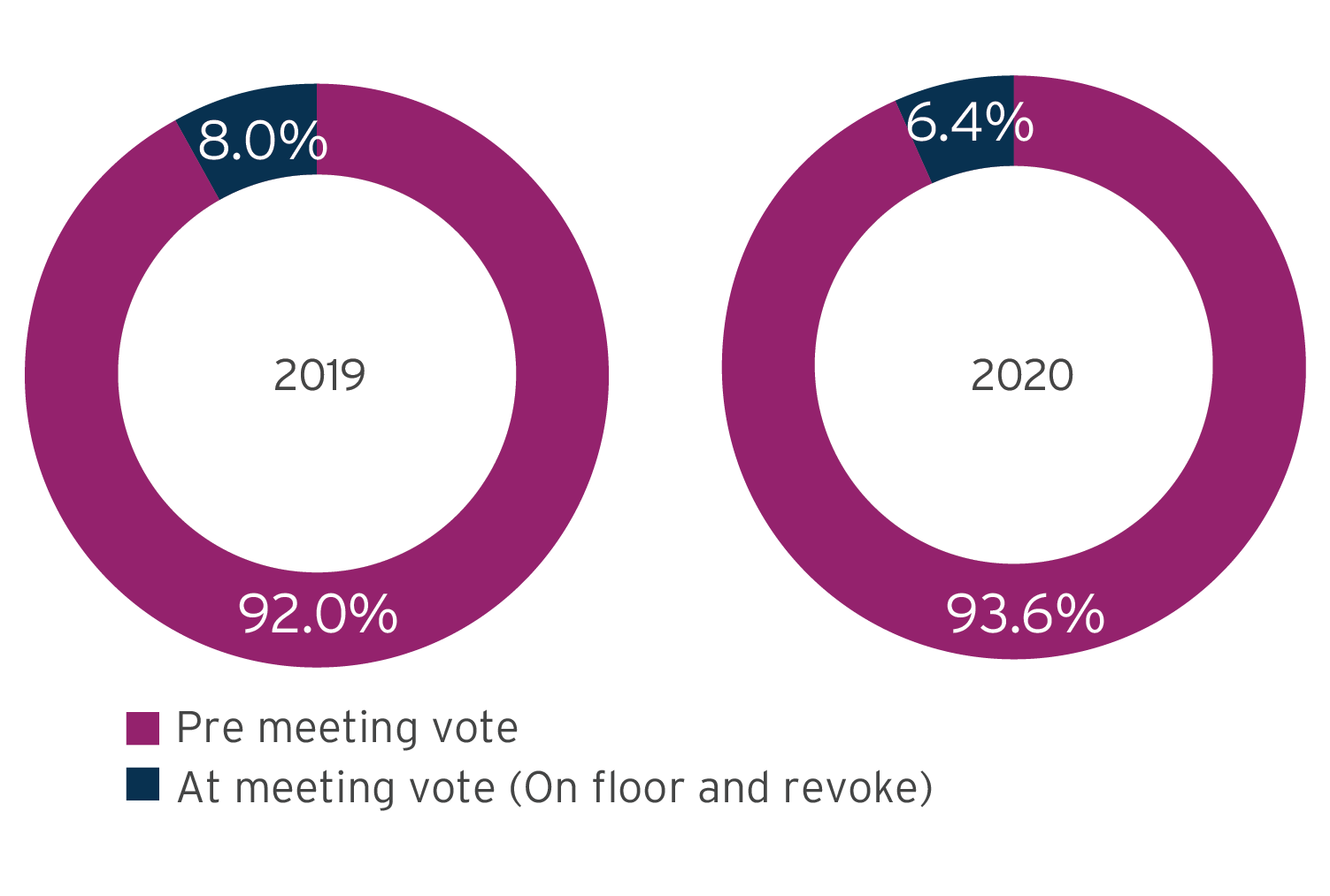

93.6% of votes were lodged prior to AGMs in 2020

Which is an increase of 1.6% from 2019, and means that the percentage of votes received prior to AGMs in 2020 was materially unchanged.

When Shareholders Voted

2021

AGM Intelligence Report

For further insight and analysis download the full report

© 2021 Computershare Limited. All rights reserved.